California Property Tax Deduction Cap . california governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the. in this guide, we'll explore everything homeowners need to know about deducting property taxes in california, including eligibility requirements,. under state law, homeowners qualify for a modest property tax cut on their primary residence. the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california homeowners. Yet some 435,000 families in l.a. A group of bipartisan house representatives relaunched the state and local tax caucus last week, calling for. on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing certain owners of passthrough entities to. a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part of trump’s 2017 tax overhaul in states with high taxes and property.

from taxfoundation.org

under state law, homeowners qualify for a modest property tax cut on their primary residence. in this guide, we'll explore everything homeowners need to know about deducting property taxes in california, including eligibility requirements,. california governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the. Yet some 435,000 families in l.a. on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing certain owners of passthrough entities to. a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part of trump’s 2017 tax overhaul in states with high taxes and property. the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california homeowners. A group of bipartisan house representatives relaunched the state and local tax caucus last week, calling for.

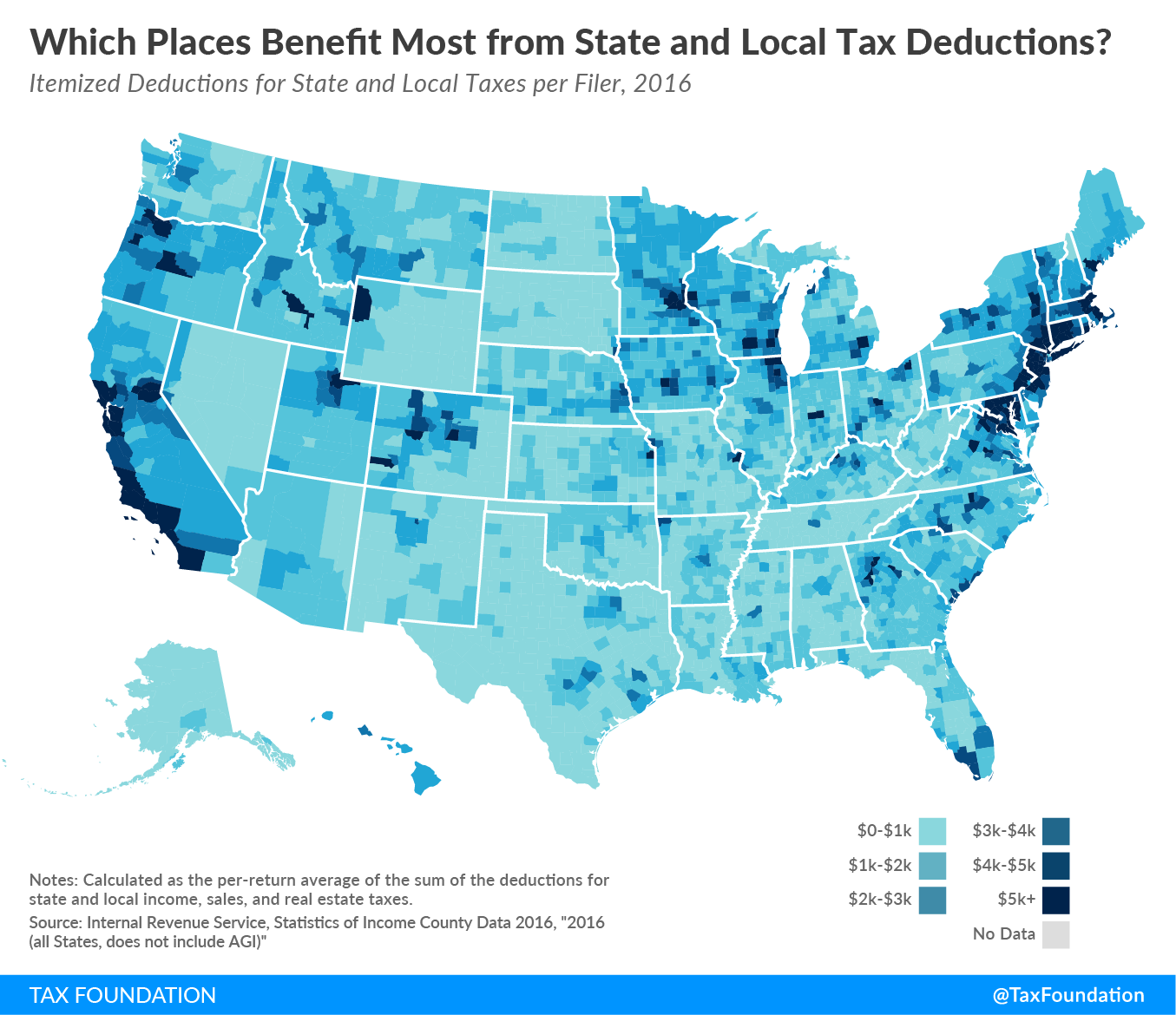

Benefits of the State and Local Tax Deduction by County Tax Foundation

California Property Tax Deduction Cap under state law, homeowners qualify for a modest property tax cut on their primary residence. Yet some 435,000 families in l.a. the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california homeowners. A group of bipartisan house representatives relaunched the state and local tax caucus last week, calling for. in this guide, we'll explore everything homeowners need to know about deducting property taxes in california, including eligibility requirements,. under state law, homeowners qualify for a modest property tax cut on their primary residence. california governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the. a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part of trump’s 2017 tax overhaul in states with high taxes and property. on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing certain owners of passthrough entities to.

From www.pewtrusts.org

Cap on the State and Local Tax Deduction Likely to Affect States Beyond California Property Tax Deduction Cap california governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the. A group of bipartisan house representatives relaunched the state and local tax caucus last week, calling for. Yet some 435,000 families in l.a. in this guide, we'll explore everything homeowners need to know about deducting property taxes. California Property Tax Deduction Cap.

From mommyalleahs.blogspot.com

how to lower property taxes in california Exuberant Vlog Ajax California Property Tax Deduction Cap under state law, homeowners qualify for a modest property tax cut on their primary residence. a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part of trump’s 2017 tax overhaul in states with high taxes and property. the $10,000 cap on state and local taxes (salt) can increase the. California Property Tax Deduction Cap.

From dxoxelzum.blob.core.windows.net

What Are Property Taxes In California Based On at Christopher Emery blog California Property Tax Deduction Cap in this guide, we'll explore everything homeowners need to know about deducting property taxes in california, including eligibility requirements,. the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california homeowners. Yet some 435,000 families in l.a. on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing. California Property Tax Deduction Cap.

From dkfnmvoneco.blob.core.windows.net

Placer County Ca Property Tax Due Dates at Byrne blog California Property Tax Deduction Cap in this guide, we'll explore everything homeowners need to know about deducting property taxes in california, including eligibility requirements,. california governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the. under state law, homeowners qualify for a modest property tax cut on their primary residence. the. California Property Tax Deduction Cap.

From naukrihiring.com

The Ultimate Guide to Real Estate Taxes & Deductions Blogging Place California Property Tax Deduction Cap under state law, homeowners qualify for a modest property tax cut on their primary residence. Yet some 435,000 families in l.a. in this guide, we'll explore everything homeowners need to know about deducting property taxes in california, including eligibility requirements,. the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california. California Property Tax Deduction Cap.

From exowtcsfx.blob.core.windows.net

How Property Taxes Work In California at Brenda Ford blog California Property Tax Deduction Cap the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california homeowners. a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part of trump’s 2017 tax overhaul in states with high taxes and property. in this guide, we'll explore everything homeowners need to. California Property Tax Deduction Cap.

From lao.ca.gov

Proposition 13 Report More Data on California Property Taxes [EconTax California Property Tax Deduction Cap Yet some 435,000 families in l.a. on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing certain owners of passthrough entities to. california governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the. the $10,000 cap on state and local taxes (salt) can. California Property Tax Deduction Cap.

From www.youtube.com

California Property Taxes Explained Alameda County Property Taxes California Property Tax Deduction Cap a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part of trump’s 2017 tax overhaul in states with high taxes and property. on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing certain owners of passthrough entities to. california governor gavin newsom recently signed assembly. California Property Tax Deduction Cap.

From www.mendocinocounty.gov

Property Tax Information Mendocino County, CA California Property Tax Deduction Cap on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing certain owners of passthrough entities to. A group of bipartisan house representatives relaunched the state and local tax caucus last week, calling for. california governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the.. California Property Tax Deduction Cap.

From whiteluxuryhomes.com

Property Tax Deductions What You Need to Know! White Luxury Homes California Property Tax Deduction Cap under state law, homeowners qualify for a modest property tax cut on their primary residence. a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part of trump’s 2017 tax overhaul in states with high taxes and property. A group of bipartisan house representatives relaunched the state and local tax caucus. California Property Tax Deduction Cap.

From cevnryan.blob.core.windows.net

Riverside County California Property Tax Assessor at Kathy Reed blog California Property Tax Deduction Cap Yet some 435,000 families in l.a. under state law, homeowners qualify for a modest property tax cut on their primary residence. the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california homeowners. a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part. California Property Tax Deduction Cap.

From taxfoundation.org

Benefits of the State and Local Tax Deduction by County Tax Foundation California Property Tax Deduction Cap on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing certain owners of passthrough entities to. the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california homeowners. in this guide, we'll explore everything homeowners need to know about deducting property taxes in california, including eligibility requirements,.. California Property Tax Deduction Cap.

From www.azibo.com

Understanding the California Property Tax Rate Azibo California Property Tax Deduction Cap A group of bipartisan house representatives relaunched the state and local tax caucus last week, calling for. a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part of trump’s 2017 tax overhaul in states with high taxes and property. in this guide, we'll explore everything homeowners need to know about. California Property Tax Deduction Cap.

From exohtwovx.blob.core.windows.net

California Keep Property Tax at Ronald Nunez blog California Property Tax Deduction Cap a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part of trump’s 2017 tax overhaul in states with high taxes and property. under state law, homeowners qualify for a modest property tax cut on their primary residence. A group of bipartisan house representatives relaunched the state and local tax caucus. California Property Tax Deduction Cap.

From www.youtube.com

How To Calculate Property Taxes State of California YouTube California Property Tax Deduction Cap california governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the. the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california homeowners. a cap on the federal tax deduction for state and local taxes, or salt, was a controversial part. California Property Tax Deduction Cap.

From lao.ca.gov

Understanding California’s Property Taxes California Property Tax Deduction Cap A group of bipartisan house representatives relaunched the state and local tax caucus last week, calling for. on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing certain owners of passthrough entities to. the $10,000 cap on state and local taxes (salt) can increase the taxable income for most california homeowners. in this. California Property Tax Deduction Cap.

From lessonmagicclouting.z21.web.core.windows.net

List Of Rental Property Tax Deductions California Property Tax Deduction Cap A group of bipartisan house representatives relaunched the state and local tax caucus last week, calling for. on july 16, 2021, governor newsom signed california assembly bill 150 into law, allowing certain owners of passthrough entities to. Yet some 435,000 families in l.a. in this guide, we'll explore everything homeowners need to know about deducting property taxes in. California Property Tax Deduction Cap.

From ceapvsqe.blob.core.windows.net

How To Calculate Property Taxes In California at Keshia Clark blog California Property Tax Deduction Cap california governor gavin newsom recently signed assembly bill 150 (ab150), which created a workaround for the current $10,000 limitation on the. in this guide, we'll explore everything homeowners need to know about deducting property taxes in california, including eligibility requirements,. A group of bipartisan house representatives relaunched the state and local tax caucus last week, calling for. . California Property Tax Deduction Cap.